-

- その他

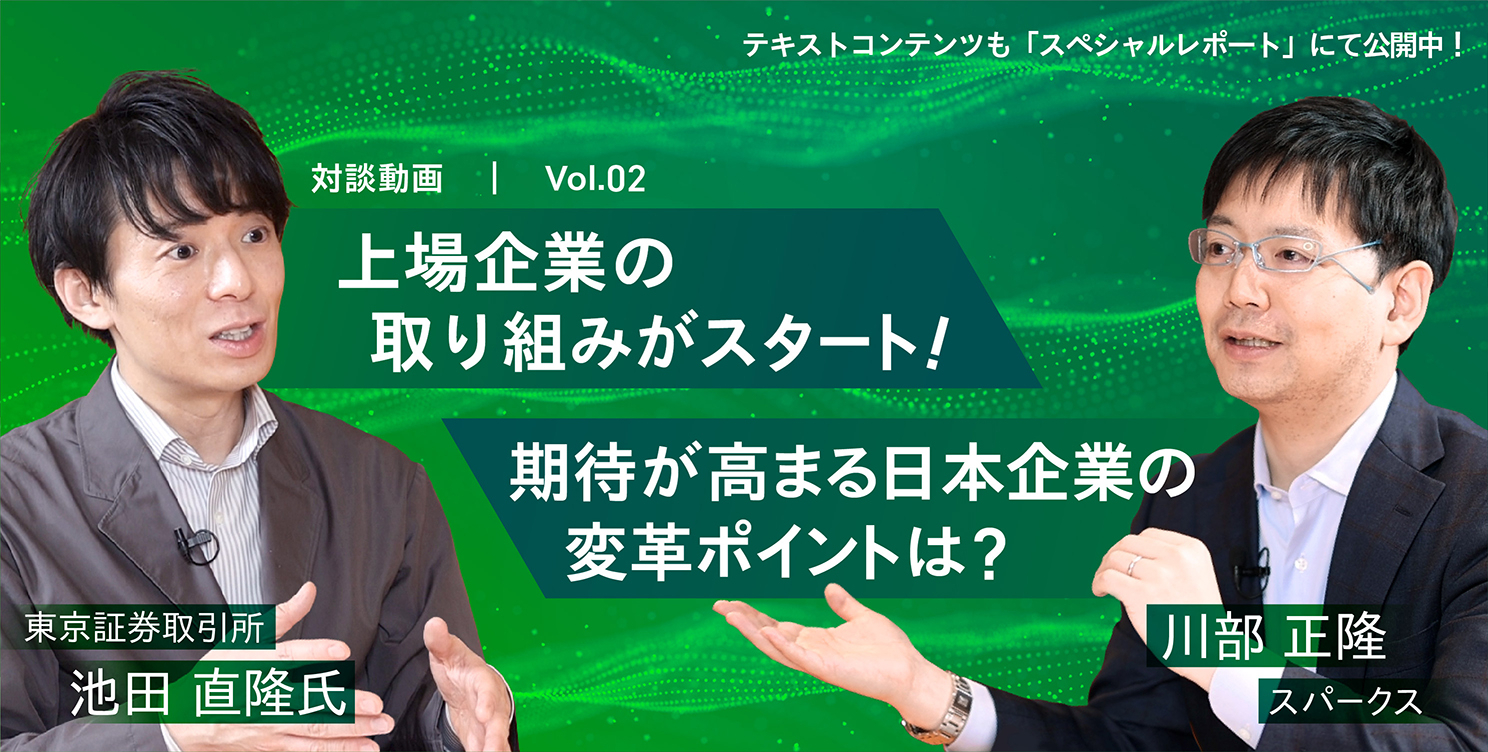

東京証券取引所との対談コンテンツ(第2弾)公開に関するお知らせ(399.6 KB)

-

- ファンドに関するお知らせ

-

- その他

「資産所得倍増プランに関する意識調査2024」実施のお知らせ(558.4 KB)

-

- その他

上智大学で実施の「アントレプレナーシップ養成講座」が閉講。可能性あるビジネスアイデア立案者4名へ総額上限1,000万円の資金を提供。

-

- ファンドに関するお知らせ

第1回 ウエルスアドバイザーアワード「"新NISA成長投資枠"WA優秀ファンド賞」受賞に関するお知らせ(646.6 KB)

-

- その他

-

- スペシャルレポート

- 川部正隆 Vol.14

-

- スペシャルレポート

- 水田孝信 Vol.34

-

- マーケットレポート

日経平均株価の最高値更新を迎えて (649.1 KB)

-

-

- マーケットレポート

2024年の日本株式市場の見通し (873.6 KB)

-

-

- ファンドレポート

新NISA制度における成⻑投資枠対象ファンドについて (232.6 KB)

-

- ファンドレポート

スパークス・企業価値創造日本株ファンド「進捗を見せる企業との対話」 (1.2 MB)

-

-

注目の投資信託

ニュース

-

- ファンドに関するお知らせ

-

- ファンドに関するお知らせ

第1回 ウエルスアドバイザーアワード「"新NISA成長投資枠"WA優秀ファンド賞」受賞に関するお知らせ(646.6 KB)

-

- ファンドに関するお知らせ

公募追加型証券投資信託の設定に関するお知らせ(3.0 MB)

-

- ファンドに関するお知らせ

「スパークス・プレミアム・日本超小型株式ファンド(愛称:価値発掘)」お買付けお申込み受付一時停止について(165.8 KB)

-

- ファンドに関するお知らせ

新NISA制度における成長投資枠対象ファンド届出のお知らせ(10月2日公表分)(462.3 KB)

-

- ファンドに関するお知らせ

新NISA制度における成長投資枠対象ファンド届出のお知らせ(461.2 KB)

-

- その他

東京証券取引所との対談コンテンツ(第2弾)公開に関するお知らせ(399.6 KB)

-

- その他

「資産所得倍増プランに関する意識調査2024」実施のお知らせ(558.4 KB)

-

- その他

上智大学で実施の「アントレプレナーシップ養成講座」が閉講。可能性あるビジネスアイデア立案者4名へ総額上限1,000万円の資金を提供。

-

- その他

-

- その他

「日本株式市場の振り返りと展望に関する意識調査2023」実施のお知らせ(647.5 KB)

-

- その他

「夫婦のマネー事情と夫婦円満投資に関する調査 2023 」実施のお知らせ(681.3 KB)

レポート

-

ニッポン解剖~日本再興へのメカニズム~ Vol.14「株主総会:個人投資家の復権」

- スペシャルレポート

- 川部正隆 Vol.14

-

株式投資で気候変動を考慮することに賛否があるのはなぜか?:気候変動解決でリターンを得る投資戦略

- スペシャルレポート

- 水田孝信 Vol.34

-

東証と考える「PBR1倍」のその先!日本株の魅力向上に欠かせない改善点を探る【東証 池田直隆氏 × スパークス川部:対談第2弾】

- スペシャルレポート

-

ニッポン解剖〜⽇本再興へのメカニズム〜Vol.13 「⽇本の根雪が変わるとき」

- スペシャルレポート

- 川部正隆 Vol.13

-

ニッポン解剖 ~日本再興へのメカニズム~ Vol.12「⽇本がベストオプションになるために」

- スペシャルレポート

- 川部正隆 Vol.12

-

日経平均株価の最高値更新を迎えて(649.1 KB)

- マーケットレポート