Our Firm

Our History

Founded in 1989, SPARX Asset Management Co., Ltd. (“SPARX”) is a private asset management company headquartered in Tokyo, Japan.

Our history dates back to the mid-1980s, when our founder Mr. Shuhei Abe established the predecessor business in New York, and prepared an investment report on takeover opportunities in Japan. He sent it to a number of renowned investors in the U.S., and received a reply from one of them. Mr. Abe successfully pitched his investment idea to this investor, and worked with him until Mr. Abe returned to Japan and founded SPARX.

This entrepreneurial spirit has defined SPARX since its founding. We have since been introducing innovative investment strategies to our global client base with our corporate vision to become the “Most Trusted and Respected Investment Company in the World”. Today, SPARX offers Japanese equity and alternative investment strategies to investors around the world with assets under management of $8.7 billion as of December 31, 2023 (JPY/USD = 140.98 WM/Reuters Close). For more up-to-date information on our asset under management by strategy, please visit http://www.sparxgroup.com/ir/data/.

In 2001, SPARX Asset Management Co., Ltd. became the first independent asset management company to become publicly listed on Japan’s JASDAQ market. In 2006, SPARX renamed itself to SPARX Group Co., Ltd., and transferred all asset management activities to a new company under the same name, SPARX Asset Management Co., Ltd. Today, SPARX Asset Management Co., Ltd. is a wholly-owned subsidiary of SPARX Group Co., Ltd., which is a publicly-listed holding company on the Prime Market of the Tokyo Stock Exchange.

Investment Philosophy

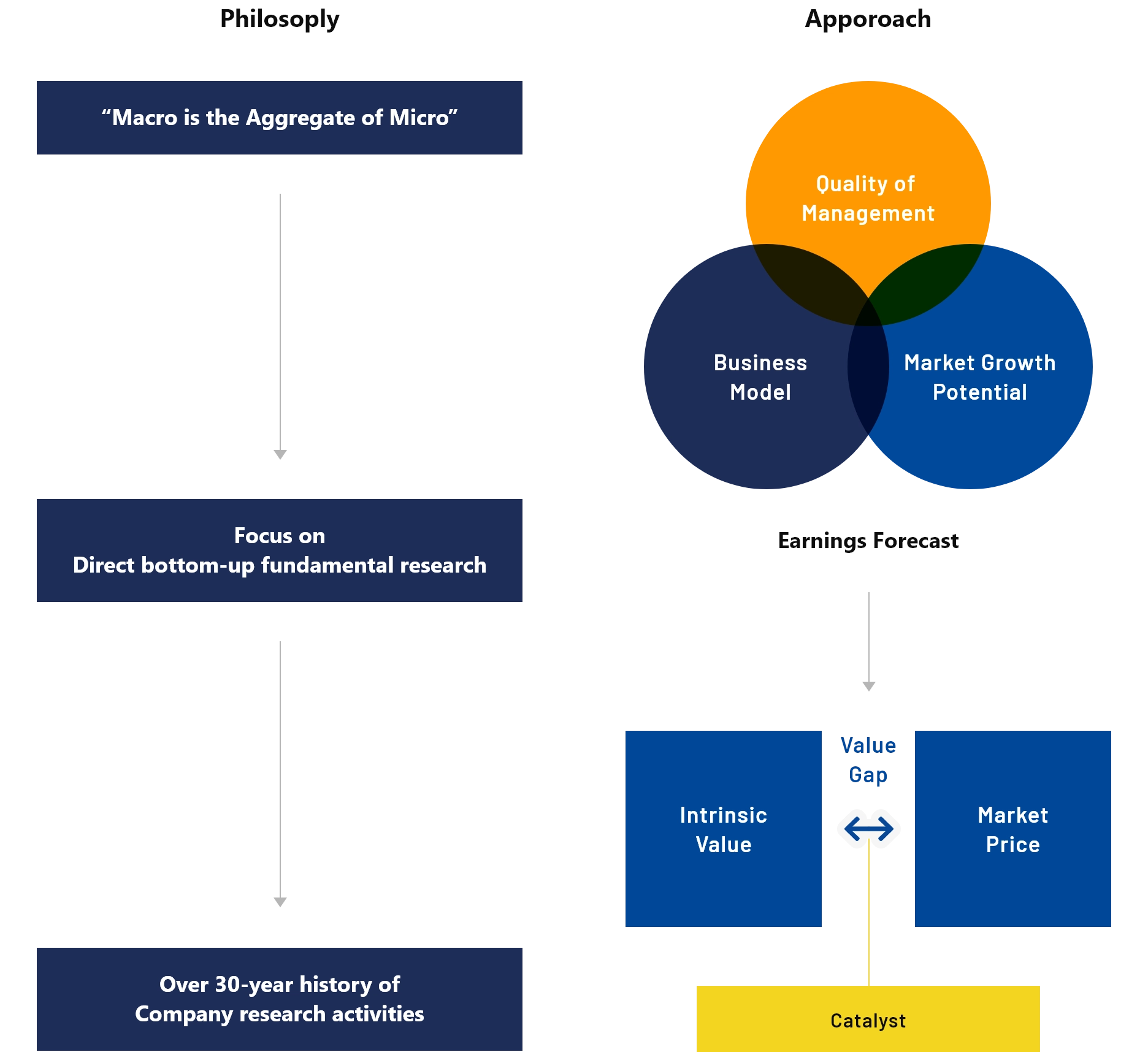

Since 1989, SPARX’s consistent firm-wide investment philosophy has been “Macro is the Aggregate of Micro”. This is a statement of our belief that the best way to generate alpha over the long run is to focus on stock selection based on direct fundamental bottom-up research, rather than a top-down approach based on sector or themes.

When we consider investing in the stock of a company, we think of it as investing in a piece of a business. We also view the stock market as efficient in the long run where stock prices reflect long-term business fundamentals, but inefficient in the short run. SPARX’s investment is therefore to participate in the narrowing of the value gap between a company’s intrinsic value and its market price over the long run.

Through our bottom-up research, we estimate intrinsic value by understanding the quality of long-term business fundamentals. As quantitative information is readily available in today’s market, we focus more on qualitative information such as quality of management, quality of earnings, and market growth potential as shown below. In 2023, our Japanese equity investment and research team located in Tokyo conducted more than 3,800 research activities.

We do not pretend to understand market movements. Instead, we focus on what we know best - individual businesses - and maintain discipline and consistency in our investment process with sufficient margin of safety and well-diversified underlying business fundamentals at the portfolio level. Changes in market environment often provide us with a great short-term buying opportunity for a long-term gain, as we believe market prices eventually come to reflect intrinsic value of the underling business.

The importance of direct bottom-up fundamental research, having a business owner’s mindset and sticking with what we know is shared across all our asset classes.

Investment Team

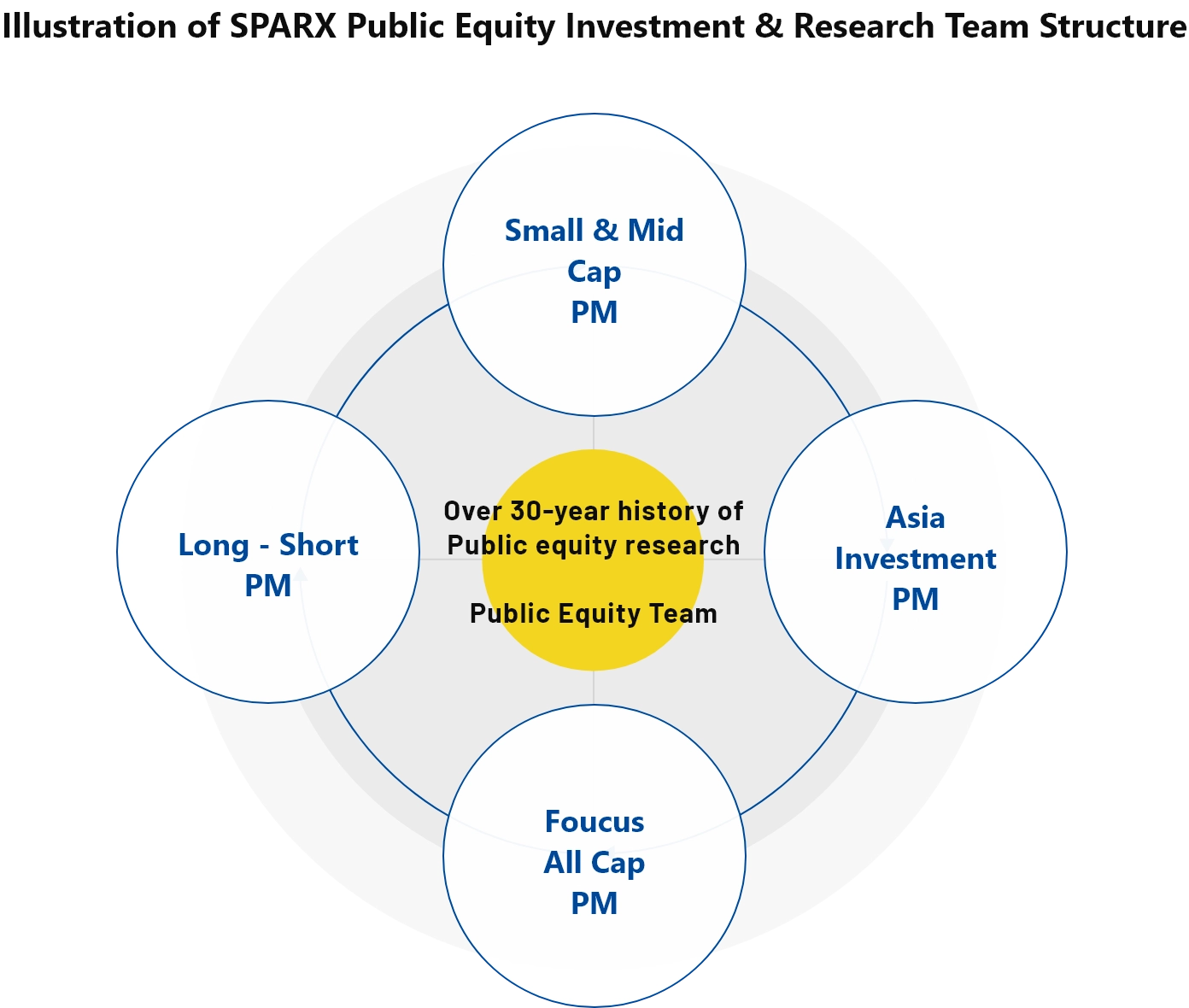

Our public equity investment & research team operates a team structure and investment processes that are designed to maximize the chance of generating alpha. It is a combination of a dedicated research team for each strategy and the pooled research platform that includes all public equity investment & research professionals.

Each individual portfolio manager is fixed on their specific strategy and are given full discretion to manage their own portfolios. At the same time, all investment professionals including portfolio managers act as an analyst in a generalist manner and are part of SPARX’s 30-year history of public equity research built on our consistent investment philosophy. Everyone pursues their own investment hypotheses with SPARX’s entrepreneurial spirit, with no predetermined restrictions such as sectors or themes. This drives our organic research process.

All our research findings and ideas are then collaborated and challenged with each other under our common research platform to identify the best ideas. Portfolio managers and analysts often come up with a new investment hypothesis through active discussions among each other on an existing hypothesis. Our research database serves as an important first step to initiate in-depth research. Often multiple portfolio managers and analysts proactively get involved in this effort, depending on the importance of the hypothesis. This naturally creates room for very active discussion, which helps them to challenge each other to produce even higher levels of conviction. Active discussion in turn leads to another set of investment hypotheses, and the process continues along this constructive cycle. This creates a top-tier in-house database, fosters independent entrepreneurial thinking, and improves idea generation, all with the goal of enhancing long-term performance.

To summarize. this structure has two distinct advantages:

- By providing full discretion to each portfolio manager, we reduce the risk of making consensus-like investment decisions, which is prevalent in typical team-based structures;

- By pooling all research resources together under a common investment philosophy, each portfolio manager can leverage a large pool of analysts, who not only provide research support but also constructively challenge the portfolio manager’s ideas.

Although the exact details are different, the underlying principle behind the team structure is the same across all our asset classes. At SPARX, everyone is an entrepreneur, and everyone helps each other to generate the best idea.

Note: The above figure is for illustrative purposes only and does not include all investment strategies. Source: SPARX Asset Management Co., Ltd.

-

We are building a sustainable society through investment.

This approach also makes the Group’s medium- to long-term growth sustainable.